One of Europe’s leading Wealth & Investment Management group with over 40,000 HNI clients spread across 80 countries in Europe, Asia and America. The client offers wealth management, investment management and other financial services across multiple countries, primarily catering to HNI expats in multiple countries.

deVere Group, an Asset Management & Insurance company wanted to build a Digital Wallet with prepaid digital card for its High Networth Individuals across the globe.

The client’s primary customers are global citizens who are essentially HNI expats traveling across multiple countries. To cater to their elite clientele and offer them a truly innovative solution, the client wanted a next gen digital fintech platform that would provide all of the client’s top financial services on a digital platform.

With competition increasing from challenger banks, fintech apps and digital banks, client wanted a comprehensive digital fintech solution that would retain it’s existing clientele and offer a complete solution with competitive rates and innovative features.

Considering the client’s focus group (global HNI customers), QuadLogix identified client’s primary business offering and accordingly built a fintech platform where all of the client’s main services could be offered on a digital platform.

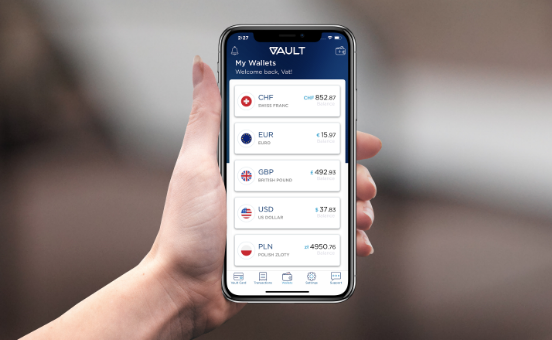

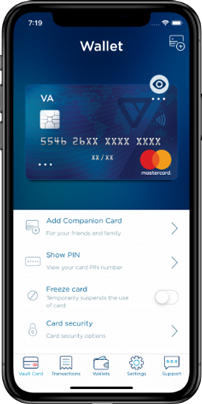

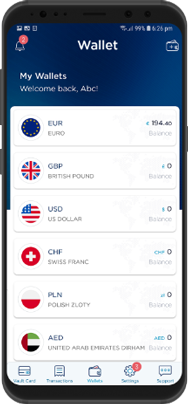

Primarily the client was looking to build a digital fintech platform that could offer –

This fintech platform includes iOS & Android apps that offer all of the above features as well as a robust backend web application for client’s team. The system works with multiple 3rd party service providers such as Payment Gateway, Currency Exchange, Payment Processor, NFC etc.

Vault digital fintech platform has enabled the client to offer financial services in a fully digital format thereby allowing client to not only retain existing customer but add new ones at a rapid pace. The customers on the other hand have been enjoying a seamless digital experience that allows them to exchange currency, transfer money, add/withdraw funds, remit funds etc.

Tell us about your Project and one of our experienced technology strategists will get in touch shortly